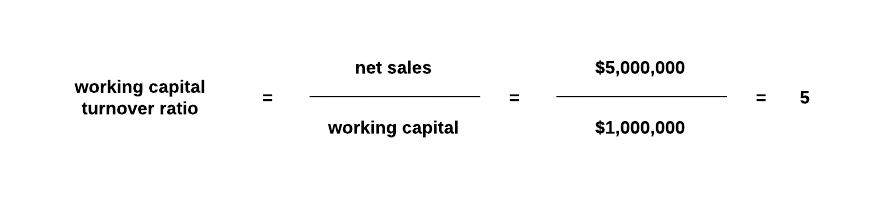

This ratio is also known as net sales to working capital and shows the relationship between the revenue generated by the company and the funds needed to generate this revenue.

Liquidity measures, such as the quick ratio and the current ratio can help a company with its short-term asset management and are looked at by lenders as part of their underwriting process. Anything higher could indicate that a company isn’t making good use of its current assets. An LBO is an acquisition of a company financed predominantly with debt. It is a formal short-term financing agreement in which the bank guarantees to advance the money when the borrowing firm requires it. A very high ratio also indicates that the business is very likely to become insolvent in the near future. However, if the ratio is extremely high - over 80 percent - it could mean that the business doesn’t have enough capital to support expansion and sales growth. A high working capital turnover ratio also gives the company an edge over its competitors. Similar to net working capital, the NWC ratio can be used to determine whether you have enough current assets to cover your current liabilities. The NWC ratio measures the percentage of a company’s current assets to its short-term liabilities. This will help increase your NWC by lowering the number of payments that are due. You can use the working capital ratio calculator below to quickly determine how easily a company can repay its debt with its assets by entering the required numbers. A ratio higher than 2.00 might indicate that a company has too much debt and is not as financially healthy as creditors would like.

To spot an extremely high turnover ratio, you need to compare the ratio for your company with other businesses in the same industry and scale. Inventory and accounts payable, on the other hand, are recorded at cost and must therefore be compared to cost of goods sold per day, not sales per day. Both sales and accounts receivable are in “retail dollars,” if you will. This is because accounts receivable includes the profit markup and is correctly compared to sales per day. Note that the ICP and the DPO calculations use cost of goods sold rather than sales in the denominator. To calculate the current ratio, you’ll want to review your balance sheet and use the following formula. The cost of delivering the service or newspaper is usually lower than revenue thus, when the revenue is recognized, the business will generate gross income.

#Working capital turnover calculator software#

A software as a service business or newspaper receives cash from customers early on, but has to include the cash as a deferred revenue liability until the service is delivered. Accrual basis accounting creating deferred revenue while the cost of goods sold is lower than the revenue to be generatedE.g. This could lead to an excessive amount of bad debts or obsolete inventory. What Is Your Working Capital Ratio And How Do You Calculate It?Ī low ratio indicates your business may be investing in too many accounts receivable and inventory to support its sales.

0 kommentar(er)

0 kommentar(er)